You might be thinking of Starting an import-export business, but it can be challenging as well as a lucrative and fulfilling venture, considering the country’s rising trade network and economic growth.

Whether you are a seasoned entrepreneur or a beginner, understanding the legal requirements, investment needs, and potential challenges is crucial to your success. This guide will walk you through the essential steps and considerations for launching an import-export business in India.

Understanding Import and Export

Import: The process of bringing goods into the country from abroad.

Export: The process of sending goods out of the country to international markets.

Legal Requirements

To operate as an importer or exporter in India, you need to fulfill several legal requirements:

- Import-Export Code (IEC): This is mandatory for any business involved in import and export activities. Without an IEC, you cannot legally ship goods in or out of India. The IEC is issued by the Directorate General of Foreign Trade (DGFT).

- GST Registration: Essential for tax purposes and to ensure compliance with the Goods and Services Tax Act. It is required for businesses with a turnover exceeding ₹40 lakhs (₹20 lakhs for northeastern states).

- Trade License: This license is necessary to legally operate your business within your local jurisdiction.

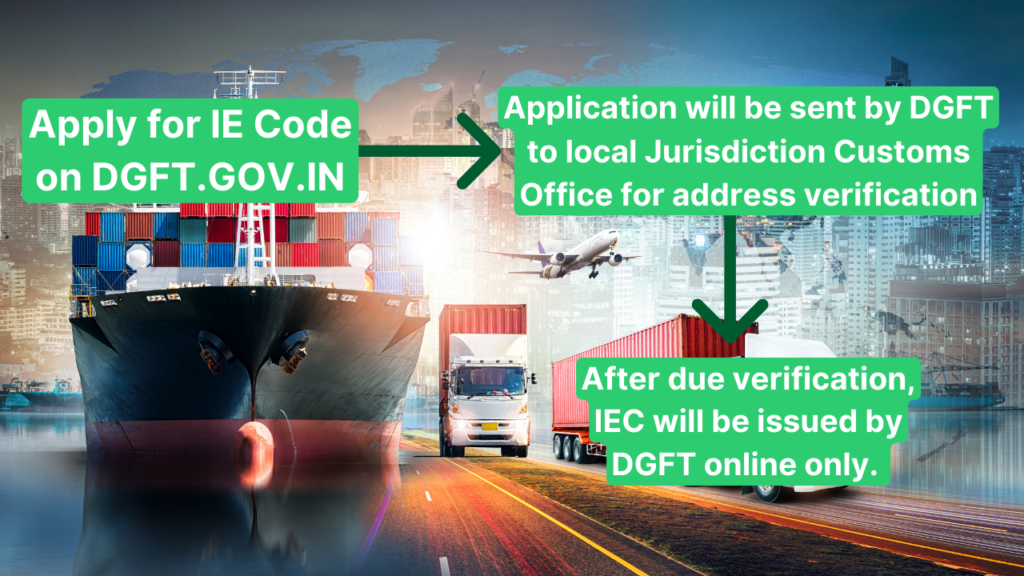

How to Obtain an IEC

Before applying for an IEC, ensure you have the following:

- PAN Card: Your Permanent Account Number, issued by the Income Tax Department.

- Aadhaar Card: A unique identification number issued by the Indian government.

- Premises Address: A verified address from which you will operate your business, such as a shop or warehouse.

Steps to Get IEC

- Apply Online: Visit DGFT.gov.in to apply for your IEC.

- Verification: The Directorate General of Foreign Trade (DGFT) will forward your application to the local customs office for address verification.

- Issuance: After verification, the IEC will be issued online by DGFT.

Capital Requirements

Obtaining an IEC and GST registration is free. However, operational costs include:

- Rent: If you rent a shop, you will need to pay monthly rent, which varies by location.

- Initial Investment: At least ₹5 lakhs for stocking goods, depending on the commodity and volume.

- Logistics Costs: These vary based on the distance and destination country.

Investment Insights

- Commodity Investment: Choose your trading commodity wisely. Understand customs regulations and notifications to avoid legal issues.

- Customs Clearance: Hire a Customs House Agent (CHA) to facilitate smooth customs clearance.

Approximate Profit Margins

- Profit Range: The average profit margin in the import-export business is around 10-15%. This can vary significantly based on the commodity.

- Example: Electronics might have a higher profit margin compared to raw materials due to higher demand and value addition.

Starting Your Import-Export Business

- Begin with Known Contacts: Start trading with people you know in other countries to avoid payment issues.

- Strategic Location: Keep your premises near the market to reduce logistics costs and time.

- Market Research: Research the demand for your chosen commodity in different countries.

- Gradual Investment: Start with a low investment to minimize risks. Gradually reinvest profits to grow your business.

Potential Challenges

- Customs Issues: Legal problems can arise if you don’t comply with customs regulations.

- Damage in Transit: Goods can get damaged while being transported.

- Quality Issues: Imported goods may sometimes be of inferior quality.

- Payment Delays: Payments for exported goods can get delayed or stuck.

Conclusion

Starting an import-export business in India requires careful planning, adherence to legal requirements, and strategic investment. Begin with a small investment and gradually expand your operations. By understanding market demands, maintaining compliance, and managing risks, you can build a successful import-export business.

1 Comment

View Comments